You’re ready to invest in Bali real estate, and everyone keeps telling you the same thing: “location, location, location.” But nobody actually breaks down which locations deliver real returns versus which ones just sound good in Instagram captions.

Uluwatu villas command premium nightly rates of $250-$500 with ocean views and luxury positioning, while Ubud property generates steady income at $140-$220 per night targeting wellness travelers and long-term stays. The winner? It depends entirely on your investment strategy, risk tolerance, and whether you prioritize peak revenue or consistent occupancy.

We’ve developed projects in both locations and manage properties across the island. This isn’t theory or marketing hype. These are the real numbers, actual occupancy rates, and honest comparisons between Bali’s two most distinct property investment markets.

The Core Difference: Luxury Tourism vs Cultural Stability

Uluwatu and Ubud aren’t just different neighborhoods. They represent fundamentally different investment philosophies, guest demographics, and revenue models.

Uluwatu is Bali’s luxury destination. Dramatic cliffside locations, world-class surf breaks, Instagram-worthy sunsets, and premium beach clubs define the area. Properties here target affluent travelers, honeymooners, and guests willing to pay $300-$500+ per night for ocean views and exclusivity.

Ubud is Bali’s cultural and wellness capital. Rice terraces, yoga shalas, art galleries, and spiritual retreats attract a completely different market. Properties target wellness seekers, digital nomads on monthly stays, yoga retreats, and travelers pursuing “authentic Bali” experiences.

The question isn’t which location is “better.” The question is which location matches your investment goals. Uluwatu delivers higher peak revenue with more volatility. Ubud delivers lower peak revenue with remarkable consistency. Both can be profitable, but they require completely different strategies.

Revenue Reality: What Properties Actually Earn

Let’s start with the numbers everyone cares about: how much money does each location generate?

Uluwatu: Premium Pricing, Seasonal Volatility

Uluwatu villas generate an average of $32,888 annually with a median ADR of $259 per night and 58% average occupancy. Top-performing properties exceed $50,000 annually, driven by luxury positioning and ocean views.

But that “average” masks dramatic performance variations:

Premium tier (top 10%): $366+ per night, 75-85% occupancy, $60,000-$120,000+ annual revenue

Strong performers (top 25%): $296+ per night, 65-75% occupancy, $45,000-$65,000 annual revenue

Median properties: $210 per night, 55-65% occupancy, $28,000-$38,000 annual revenue

Struggling properties (bottom 25%): $164 per night, 43-55% occupancy, $18,000-$25,000 annual revenue

The gap between top and bottom performers in Uluwatu is massive because the market rewards truly exceptional properties (best views, best design, best amenities) while punishing mediocre ones. Generic villas without ocean views struggle to justify premium pricing.

Ubud: Moderate Pricing, Consistent Performance

Ubud property generates $18,000-$28,000 annually for typical 2-3 bedroom villas with ADRs of $140-$220 per night and 65-75% occupancy. Top performers reach $35,000-$45,000 annually, particularly properties successfully targeting monthly yoga retreats.

Performance is more compressed:

Top performers: $200-$280 per night, 75-80% occupancy, $35,000-$45,000 annual revenue

Median properties: $140-$180 per night, 65-75% occupancy, $22,000-$30,000 annual revenue

Lower performers: $100-$140 per night, 60-70% occupancy, $18,000-$24,000 annual revenue

The gap between top and bottom is narrower because Ubud’s market is less driven by luxury positioning and more by cultural authenticity, wellness amenities, and proximity to attractions.

💰 Annual Revenue Comparison (2-3BR Villas)

| Metric | Uluwatu | Ubud | Winner |

| Average ADR | $259 | $165 | Uluwatu (+57%) |

| Average Occupancy | 58% | 70% | Ubud (+12pts) |

| Annual Revenue (median) | $32,888 | $25,000 | Uluwatu (+32%) |

| Top 10% Revenue | $80,000+ | $40,000+ | Uluwatu (+100%) |

| Revenue Stability | Highly seasonal | Year-round stable | Ubud |

Key insight: Uluwatu wins on peak revenue potential, especially for exceptional properties. Ubud wins on occupancy consistency and year-round performance. Your choice depends on whether you prioritize maximum revenue or minimum vacancy.

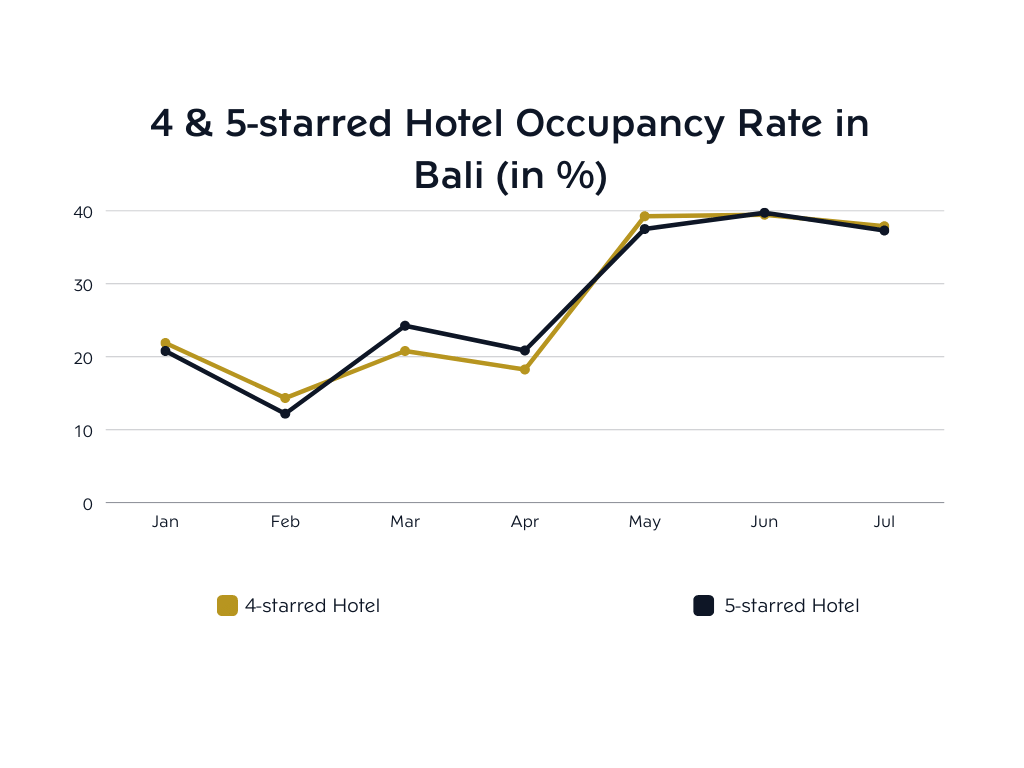

Occupancy Patterns: Seasonality vs Stability

Revenue means nothing without understanding how bookings flow throughout the year. This is where the two locations diverge dramatically.

Uluwatu: Extreme Seasonality

Uluwatu experiences pronounced seasonal swings that directly impact cash flow:

Peak season (July-August, December-January): 85-95% occupancy, rates jump 40-60%, monthly revenue hits $5,000-$9,000+

Shoulder season (April-June, September-November): 55-70% occupancy, standard rates, monthly revenue $2,800-$4,500

Low season (February-March): 40-55% occupancy, discounted rates 20-30%, monthly revenue drops to $1,800-$3,200

The surf season drives bookings. July-September brings consistent swell to Uluwatu’s world-famous breaks, filling properties with surfers willing to pay premium rates. But when the surf dies down or monsoons bring rain, occupancy plummets.

Implications for investors:

- Annual revenue concentrates in 4-5 peak months

- Cash flow swings require significant reserves

- Marketing must pivot seasonally (luxury couples in peak, budget surfers in low)

- Properties can’t rely on year-round bookings to cover fixed costs

Ubud: Remarkable Year-Round Consistency

Ubud maintains 75-80% occupancy year-round, significantly less seasonal than any coastal area. This stability stems from its diverse guest mix:

Peak months (July-August, December): 78-85% occupancy, modest rate increases 15-25%, monthly revenue $2,800-$4,200

Standard months (March-June, September-November): 70-78% occupancy, base rates, monthly revenue $2,400-$3,500

Quieter months (January-February): 65-72% occupancy, slight discounts 10-15%, monthly revenue $2,200-$3,200

The consistency comes from attracting 100,000 monthly visitors pursuing wellness, culture, and spiritual experiences that aren’t weather-dependent. Yoga retreats book year-round. Digital nomads stay 1-3 months regardless of season. Cultural tourists visit temples and rice terraces in any weather.

Implications for investors:

- Predictable monthly cash flow year-round

- Lower reserve requirements for slow periods

- Can budget expenses and plan maintenance with confidence

- Less marketing intensity required (stable demand)

Line graph showing monthly occupancy rates over 6 months Line graph showing monthly occupancy rates over 6 months |

Ubud’s occupancy stability is its superpower. While Uluwatu villas might generate 30% more annual revenue, Ubud properties deliver that income predictably every single month. For investors who value sleep over spreadsheets, that consistency is worth the revenue difference.

Investment Entry Costs: What You’ll Actually Pay

Revenue potential matters, but you can’t evaluate ROI without knowing what you’re paying to enter each market.

Uluwatu: Premium Land, Premium Construction

Land costs in Uluwatu run significantly higher than most Bali locations due to limited supply and clifftop positioning:

Clifftop land with ocean views: $400-$800 per sqm (30-year leasehold)

Hillside with partial views: $250-$400 per sqm

Inland Uluwatu (Pecatu, Bingin interior): $150-$300 per sqm

Construction costs also run higher due to:

- Difficult terrain requiring more foundation work

- Premium finishes expected by luxury market

- Infinity pools and architectural drama needed to justify rates

- Higher material transport costs to remote clifftop locations

Typical total investment for new construction:

– 2BR clifftop villa: $450,000-$700,000

– 3BR clifftop villa: $650,000-$1,200,000

– 2BR hillside villa: $350,000-$550,000

Buying existing properties:

– 2BR villa with views: $400,000-$800,000

– 3BR villa with views: $600,000-$1,200,000+

– 2BR inland villa: $300,000-$500,000

Ubud: More Accessible Entry Points

Land costs in Ubud are notably lower, providing more accessible entry:

Rice field frontage: $200-$350 per sqm (30-year leasehold)

Jungle locations near town: $150-$250 per sqm

Village locations (Tegallalang, Payangan): $100-$180 per sqm

Construction costs are moderate:

- Easier terrain and better road access

- Wellness aesthetic doesn’t require luxury finishes

- Natural materials (bamboo, local stone) cost less than imported modern materials

- Simpler designs work well for the market

Typical total investment for new construction:

– 2BR villa with rice field views: $280,000-$450,000

– 3BR villa with rice field views: $400,000-$650,000

– 2BR jungle villa: $220,000-$380,000

Buying existing properties:

– 2BR villa with views: $250,000-$450,000

– 3BR villa with views: $380,000-$650,000

– 2BR standard location: $180,000-$320,000

💵 Investment Entry Cost Comparison

| Villa Type | Uluwatu Cost | Ubud Cost | Difference |

| 2BR Premium Location | $500,000 | $350,000 | -30% |

| 3BR Premium Location | $750,000 | $500,000 | -33% |

| 2BR Standard Location | $400,000 | $280,000 | -30% |

| Land Only (per sqm) | $300-$600 | $150-$300 | -50% |

Ubud offers 30-50% lower entry costs for comparable villa quality. This matters enormously for ROI calculations since you’re generating returns on a smaller capital base.

ROI Comparison: The Real Returns After All Expenses

Now let’s combine revenue, costs, and operating expenses to calculate actual ROI for each location.

Uluwatu: Higher Revenue, Higher Costs, Moderate ROI

Example: 3BR clifftop villa

– Investment: $700,000

– Annual revenue: $42,000 (58% occupancy at $280/night)

– Operating expenses (55%): $23,100

– Net operating income: $18,900

– Income tax (10%): $1,890

– Net profit: $17,010

– Cash-on-cash ROI: 2.4%

The lower occupancy and higher operating costs (premium staff, expensive maintenance on clifftop properties, higher utilities) compress margins. Yes, nightly rates are higher, but vacancy periods and operational complexity eat into returns.

Top 10% properties perform better:

– Investment: $700,000

– Annual revenue: $65,000 (75% occupancy at $320/night)

– Operating expenses (52%): $33,800

– Net operating income: $31,200

– Income tax (10%): $3,120

– Net profit: $28,080

– Cash-on-cash ROI: 4.0%

Ubud: Lower Revenue, Lower Costs, Competitive ROI

Example: 3BR rice field villa

– Investment: $450,000

– Annual revenue: $28,000 (72% occupancy at $165/night)

– Operating expenses (48%): $13,440

– Net operating income: $14,560

– Income tax (10%): $1,456

– Net profit: $13,104

– Cash-on-cash ROI: 2.9%

Lower entry cost and lower operating expense ratio (simpler maintenance, lower staff costs, consistent occupancy reducing marketing spend) deliver competitive returns despite lower gross revenue.

Top performers with retreat optimization:

– Investment: $450,000

– Annual revenue: $38,000 (78% occupancy + monthly retreats)

– Operating expenses (46%): $17,480

– Net operating income: $20,520

– Income tax (10%): $2,052

– Net profit: $18,468

– Cash-on-cash ROI: 4.1%

📈 ROI Comparison Summary

| Property Tier | Uluwatu ROI | Ubud ROI |

| Top 10% performers | 4.0-5.5% | 4.1-5.8% |

| Median properties | 2.4-3.2% | 2.9-3.7% |

| Below average properties | 1.2-2.0% | 2.0-2.6% |

| Advantage | Higher ceiling | Higher floor |

Ubud consistently delivers 0.3-0.7% better ROI for median properties because lower entry costs and operating expenses offset the revenue difference. But Uluwatu’s top-tier properties can achieve higher absolute ROI if you nail the location, design, and positioning. The key word is “if.”

Operating Complexity: What Running Each Property Actually Requires

ROI calculations don’t capture operational difficulty. Some investments are easy to manage, others require constant attention.

Uluwatu: High Maintenance, Guest Expectations

Uluwatu villas demand more operational intensity:

Guest expectations are extreme: Paying $350/night creates expectations for perfection. One wifi hiccup, one pool maintenance delay, one missing amenity generates negative reviews that crater your ranking.

Maintenance is more expensive: Salt air accelerates corrosion. Clifftop locations face wind exposure. Infinity pools require more frequent servicing. Access difficulties increase repair costs.

Staff requirements are higher: Luxury properties need premium housekeeping, landscaping, and concierge services. Staff costs run 15-20% higher than Ubud equivalents.

Marketing requires constant optimization: Competition is intense. You’re competing with 5-star resorts and ultra-luxury villas. Professional photography, video content, and active social media presence are mandatory.

Seasonality requires strategic pivots: Peak season targets luxury couples and families. Low season pivots to budget surfers and backpackers. This requires different pricing, marketing messages, and guest management approaches.

Ubud: Simpler Operations, Consistent Demand

Ubud property operations are more straightforward:

Guest expectations are more forgiving: Wellness travelers prioritize authenticity over perfection. They accept rustic charm, natural materials showing age, and occasional tropical inconveniences.

Maintenance is simpler: No salt air corrosion. Jungle locations have easier access. Natural materials and simpler designs require less upkeep.

Staff costs are lower: Standard hospitality service works fine. No need for premium concierge or luxury-level detailing.

Marketing is less intensive: Consistent demand means less need for aggressive promotion. Good photos, accurate descriptions, and solid reviews carry properties through all seasons.

Year-round strategy remains consistent: Same guest profile, same messaging, same pricing strategy works 12 months. No seasonal pivots required.

Guest Demographics: Who Actually Books Each Location

Understanding your target market determines design decisions, pricing strategy, and marketing approach.

Uluwatu Guest Profile

Primary markets:

- Luxury couples and honeymooners (35%): $300-$500/night budget, 3-5 night stays, booking 2-4 months ahead

- Affluent families (25%): $350-$600/night for larger villas, 5-7 night stays, peak season only

- Surf groups (20%): $200-$350/night split between 4-6 people, 7-14 night stays, flexible on dates

- Instagram influencers and content creators (10%): Seek free stays or heavy discounts in exchange for content

- Yoga retreats and wellness groups (10%): Book entire villas for 7-14 nights, good low-season filler

Guest origin: 40% Europe (Germany, UK, France), 30% Australia, 20% North America, 10% Asia

Booking lead time: 45-90 days for peak season, 14-30 days for shoulder/low season

Average length of stay: 4.2 nights

Ubud Guest Profile

Primary markets:

- Wellness travelers and yoga enthusiasts (30%): $120-$220/night, 5-10 night stays, book 1-3 months ahead

- Digital nomads on monthly stays (25%): $1,800-$3,200/month, 30-90 day stays, flexible booking

- Cultural tourists (20%): $140-$200/night, 3-5 night stays, combine with beach locations

- Yoga retreat groups (15%): Book entire villas for 7-21 nights, premium rates possible

- Artists and creatives (10%): Seek longer stays 14-30 nights, lower rates accepted

Guest origin: 35% Europe (especially Germany, Netherlands), 25% North America, 20% Australia, 20% Asia

Booking lead time: 30-60 days typical, monthly guests book 60-120 days ahead

Average length of stay: 6.8 nights (significantly longer than Uluwatu)

👥 Guest Comparison

| Factor | Uluwatu | Ubud |

| Primary motivation | Luxury, surf, views | Wellness, culture, nature |

| Average nightly budget | $280-$450 | $150-$220 |

| Average stay length | 4.2 nights | 6.8 nights |

| Booking lead time | 45-90 days peak | 30-60 days typical |

| Guest difficulty | High expectations | More forgiving |

| Repeat booking potential | Low (destination visit) | Moderate to high |

Infrastructure and Accessibility: The Practical Realities

Investment decisions can’t ignore practical considerations that impact guest experience and property management.

Uluwatu Infrastructure

Road access: Significantly improved but still challenging in some areas. Narrow clifftop roads make access difficult for larger vehicles. Some properties require scooter-only final approach.

Restaurants and amenities: Growing but limited compared to Canggu or Seminyak. Most dining concentrated in Bingin, Padang Padang, and near Single Fin. Guests need scooters or drivers for daily errands.

Airport distance: 45-75 minutes depending on exact location and traffic. Adds to guest arrival/departure complexity.

Utilities reliability: Improving but occasional water pressure issues in dry season. Electricity generally stable. Internet quality varies significantly by location.

Medical facilities: Limited. Nearest hospital is 30-45 minutes. This matters for families with young children.

Ubud Infrastructure

Road access: Good main roads but narrow village lanes. Traffic congestion significant during peak hours. Most properties easily accessible by car.

Restaurants and amenities: Extensive. Hundreds of restaurants, cafes, yoga studios, spas, markets, and shops within 5-15 minutes of most properties. Guests can walk or use short scooter rides.

Airport distance: 60-90 minutes depending on traffic. Longer than Uluwatu but guests tend to stay longer anyway.

Utilities reliability: Generally excellent. Water supply stable. Electricity reliable. Internet quality consistently good given digital nomad demand.

Medical facilities: Good. Multiple clinics, 24-hour medical center, hospitals within 15-20 minutes.

Uluwatu wins on Instagram appeal, Ubud wins on practical convenience. Guests booking Uluwatu accept infrastructure limitations because they’re paying for views and exclusivity. Guests booking Ubud expect and get full convenience because that’s core to the wellness experience.

Future Growth Trajectory: Which Location Has More Upside?

Historical performance matters, but smart investors also consider future growth potential and risks.

Uluwatu’s Growth Potential

Positive factors:

- Google Trends and social media showing Uluwatu rapidly closing gap with Canggu in search interest

- Still relatively underdeveloped compared to Canggu/Seminyak, leaving room for appreciation

- Luxury tourism globally growing faster than budget travel

- Limited remaining clifftop land creates scarcity value

- New beach clubs and restaurants improving infrastructure

Risk factors:

- Over-development on limited land could destroy exclusive appeal

- Traffic congestion already problematic on single-lane clifftop roads

- Water scarcity issues during peak dry season

- Environmental concerns about clifftop construction sustainability

- High entry costs limit potential buyer pool for resale

Outlook: Moderate to strong appreciation potential (4-7% annually) but higher volatility. Properties with best locations and views will appreciate faster. Generic inland properties may struggle.

Ubud’s Growth Potential

Positive factors:

- Ubud declared UNESCO Creative City enhancing international profile

- Wellness tourism growing globally at 10-12% annually

- Digital nomad visa programs in Indonesia supporting long-term stay demand

- Consistent performer through decades shows market stability

- More affordable entry points allow broader buyer participation

Risk factors:

- Already well-developed with limited vacant land in prime central areas

- Traffic congestion and parking increasingly problematic

- Development restrictions in rice terrace zones limit supply growth

- Cultural tourism vulnerable to shifts in travel trends

- Lower absolute prices mean lower absolute appreciation gains

Outlook: Steady appreciation (3-5% annually) with low volatility. Consistent, reliable, but unlikely to deliver explosive growth.

Which Location Is Right for Your Investment Strategy?

Neither location is universally “better.” The right choice depends on your specific investment goals, risk tolerance, and operational preferences.

Choose Uluwatu If You:

- Have $500,000+ capital to invest in premium positioning

- Can handle seasonal revenue swings and maintain reserves

- Want maximum revenue potential and top-tier property performance

- Are comfortable with higher operational complexity

- Can secure truly exceptional location (ocean views, clifftop, near surf breaks)

- Plan to use the property personally and value luxury lifestyle

- Can afford professional management handling seasonal marketing pivots

- Accept higher risk for higher potential reward

Choose Ubud If You:

- Have $250,000-$500,000 capital seeking accessible entry

- Prefer predictable monthly cash flow over peak revenue

- Want simpler operations and lower management intensity

- Value occupancy consistency and year-round performance

- Can optimize property for wellness/retreat market (yoga space, meditation area)

- Prefer lower volatility and more stable long-term returns

- Plan primarily income investment rather than personal use

- Accept moderate returns for reliable performance

🎯 Quick Decision Framework

| Your Priority | Recommended Location |

| Maximum revenue potential | Uluwatu (if you can afford top tier) |

| Consistent occupancy | Ubud |

| Lower entry cost | Ubud (-30 to -50%) |

| Easier operations | Ubud |

| Luxury lifestyle use | Uluwatu |

| Stable cash flow | Ubud |

| Future appreciation | Uluwatu (higher ceiling, higher risk) |

| Best median ROI | Ubud (+0.5-0.7%) |

The Portfolio Approach: Why Not Both?

Sophisticated investors increasingly choose both locations to diversify risk:

- Uluwatu villa for peak season revenue: Generates strong cash during high season

- Ubud villa for year-round stability: Provides consistent baseline income

This strategy smooths overall portfolio volatility while capturing upside from both markets. When Uluwatu is slow (February-March), Ubud remains solid. When both are strong (July-August), portfolio performance is exceptional.

The Honest Bottom Line

Uluwatu villas deliver higher gross revenue ($32,888 vs $25,000 median annual) with premium nightly rates and exceptional upside potential for top-tier properties. But seasonal volatility, higher entry costs, and operational complexity require sophisticated management and significant capital reserves.

Ubud property delivers more consistent performance with better median ROI (2.9% vs 2.4%), year-round occupancy stability, and significantly lower entry costs ($280,000-$450,000 vs $400,000-$700,000). Operations are simpler, guests are more forgiving, and cash flow is predictable.

For most investors, Ubud offers better risk-adjusted returns. You’ll earn slightly less annual revenue but on 30-50% less capital with dramatically more stable operations. For investors with $500,000+ capital who can secure exceptional Uluwatu locations and handle seasonal complexity, the luxury market offers genuine upside.

The real answer? Both locations work, but they require completely different strategies. The worst decision is choosing a location because it “sounds better” rather than matching it to your actual investment goals, capital constraints, and operational tolerance.

🚀 Ready to Invest in the Right Location?

We’ve developed projects in both Uluwatu and Ubud, and we manage properties across both markets. Whether you’re drawn to Uluwatu’s luxury clifftop positioning or Ubud’s cultural wellness stability, we provide transparent financial projections based on real market data, not fantasy figures.

We handle everything: finding the right land, architectural design matched to market positioning, construction management, legal structuring, property management, and ongoing optimization. You get access to our actual performance data across 40+ managed properties, real occupancy numbers, and honest projections that account for seasonality and operating expenses.

The Bali real estate opportunity is real in both locations. The key is matching your investment to your strategy. With proper location selection, realistic expectations, and professional management, both Uluwatu and Ubud deliver genuine returns. Just know which location matches your goals before you commit.

Property investment Bali requires understanding that location isn’t just about geography. It’s about guest demographics, operational complexity, revenue patterns, and risk tolerance. Choose wisely, and either Uluwatu villas or Ubud property can deliver the returns you’re seeking.